ohio sales tax exemption form example

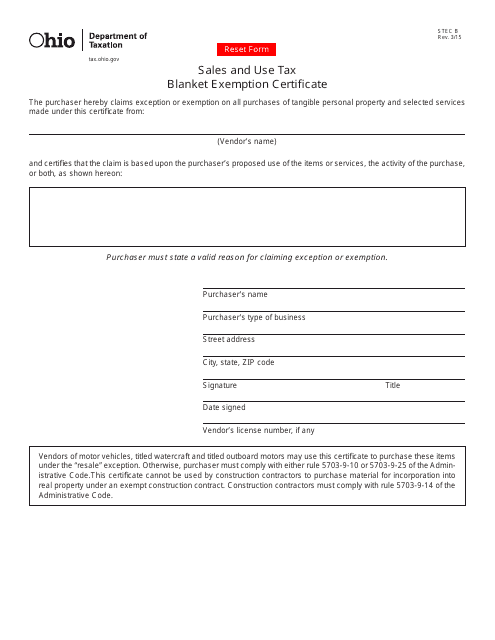

02 B 1 OF THE. Sales and Use Tax Blanket Exemption Certificate.

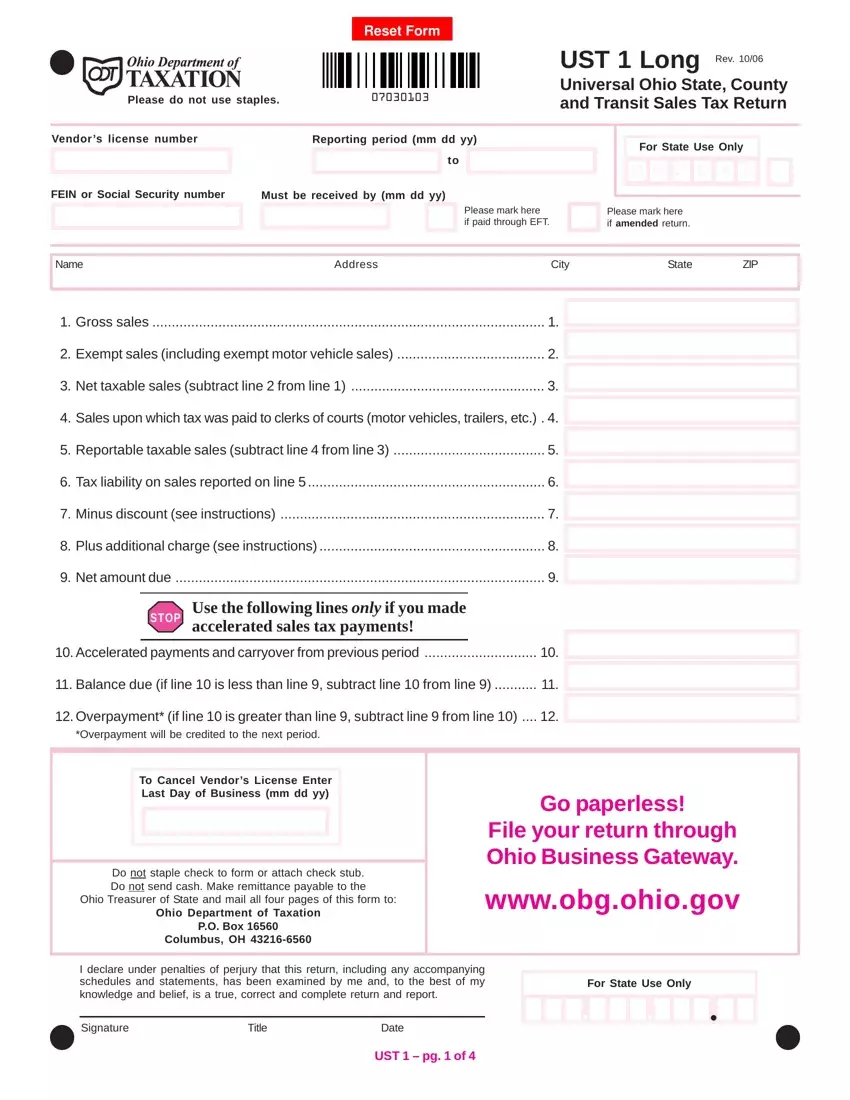

Ohio Sales Tax Ust 1 Fill Out Printable Pdf Forms Online

Web STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all.

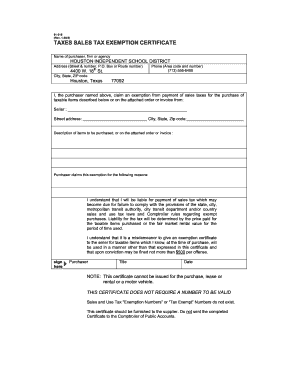

. Web Use tax must be paid on all purchases made by Ohio residents and businesses if the proper amount of sales tax has not been paid to the vendor seller or service provider. You can use the. Web This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract.

Web Sales taxes can be complex and trying to understand the exemptions can be daunting. For other Ohio sales tax exemption certificates go here. On the next line enter the purchasers street address.

Sales tax exemption in the state applies to certain types of food. Enter a full or partial form. Web The first is the Ohio sales tax manufacturing exemption which is available to manufacturers who produce goods in Ohio.

Ohio Sales And Use Tax Blanket Exemption. Web For example a business located in Adams County pays the state tax rate of 575 percent plus the countys tax rate of 150 percent. Web Quick steps to complete and e-sign Tax exemption documentation online.

Web WH Warehousing - Sales of a motor vehicle which will be used as a yard truck to transport purchased inventory in a warehouse distribution center or similar facility are exempt. This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form. The second is the Ohio sales tax agricultural.

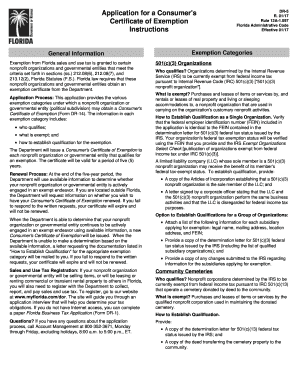

The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions. Web Ohio Sales And Use Tax Blanket Exemption Certificate STEC-B Step 4. Web Sample Certificate Tax Exempt Certificate Form is a free printable for you.

Use Get Form or simply click on the template preview to open it in the editor. Web By its terms this certificate may be used only for claiming an exemption based on resale or on the incorporation of the item purchased into a product for sale. Start completing the fillable.

Web The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Web You can download a PDF of the Ohio Blanket Exemption Certificate Form STEC-B on this page. Web In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

This form may be. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user.

Any business owner who purchases taxable.

Ohio Stec B Fill And Sign Printable Template Online

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Ohio Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Ohio Sales Tax Exemption For Manufacturing Agile Consulting

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Ohio W 9 Form Fill Out Sign Online Dochub

Ohio Sales Tax Guide For Businesses

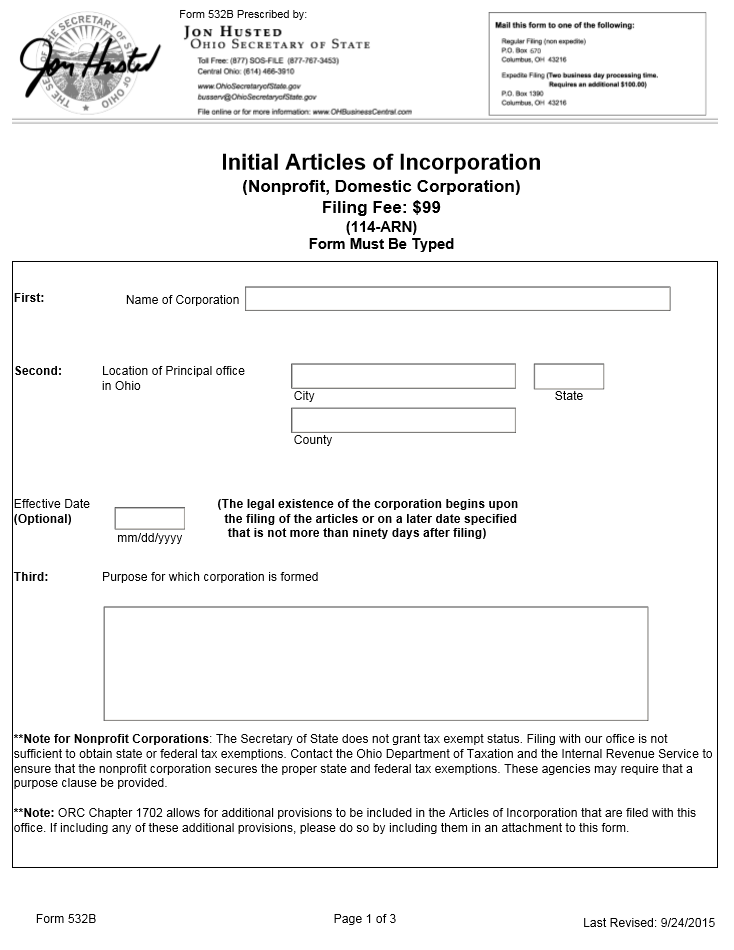

Free Ohio Nonprofit Articles Of Incorporation Nonprofit Domestic Corporation Form 532b

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Country Mfg Ohio Tax Exemption Form Faxable

Health Freedom Ohio Vaccine Laws And Info

Ohio Sales Tax Small Business Guide Truic

Get Ohio Tax Exempt Form And Fill It Out In November 2022 Pdffiller

![]()

Llc Ohio How To Start An Llc In Ohio Truic

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller